Thursday, December 23, 2010

thoughts for the season of buying shit

Sunday, December 5, 2010

Let's blame the new generation

The author's point, like most people who complain about these things (including myself), is that the internet and social media are lowering the standards of activism so that someone can feel warm and fuzzy about helping abused children without actually having done jack shit - "slactivism" is the incredibly annoying neologism I've read a few times to describe this phenomenon. As anyone arguing about the activism (or lack thereof) of young people today must do, Gladwell brings up the rightly legendary sacrifices of the civil rights protestors, marchers, etc. And hey, maybe a little shame would get some people (again, including myself) off their asses and out to an actual protest. But, it's really not a good argument he's making.

Gladwell is essentially saying that we can compare the 500 million users of Facebook (and OK, not all of them are students) to the tens of thousands of student activists who did so much in the fight for civil rights. Can anyone spot the problem here? He's taken the top couple percent of the 50's and 60's student population in terms of activism and is claiming that since more people than live in the United States are not doing the same work that they did, the internet must be making us soft.

Now, by saying what I'm about to say, I am being equally non-evidence-based as Gladwell was, but I'm going to say it anyway. I would put my money on the internet and social media in fact increasing rates of activism among young people - if we look at the number of students today who are active comparably to the civil rights activists. The problem here isn't that it's so easy to do something meaningless - it's ALWAYS been easy to do something meaningless. The problem is that those meaningless things are so much more visible now. For every civil rights activist - and anti-civil rights activist - in the 50's and 60's, there were lots of people who didn't do anything - just like changing your profile picture doesn't do anything. The problem is that no one knew they weren't doing anything, because there wasn't a global platform for them to not do anything on!

Anyway. Sorry this is so badly written, I have been working non-stop for the past week and my brain is rather tired. Also, since Dave and Ben are both unlikely to have blog access for the next little while, I guess it's just me, Sarah, and Lion (and maybe Dan) on this one.

------------------------------------------------------------

* I would like to point out that my profile picture has been Milhouse since October 22, and that changing it from a cartoon character to something else to avoid the campaign would simply be giving in to the moronism.

Thursday, October 21, 2010

A Wave of Cold Water

The one sobering thought that veteran Republican consultants are already contemplating is that the larger the wave this year, the more difficult it will be to hold onto some of these seats in 2012 and 2014 in the House and 2016 in the Senate.I'll admit, when I first read the article, I was encouraged. On its face, it seems logical. If the Republicans make big gains this year, they will come in regions that are demographically trending blue, they look to be relying on depressed democratic turnout, and of course this crop of Republican candidates is particularly insane. It's somewhat cold comfort for those of us who had hoped for a continued legislative agenda that wasn't bogged down by fishing expeditions and threats of government shutdown, but this kind of analysis offers, dare I say it, hope. All we need to do is tough it out for two years, and we'll be okay again. The Republicans will stretch themselves too far, far beyond the actual geographic contours of their party, and a large correction will follow. At that point, assuming the economy doesn't crash groin-first into a cactus again, Obama keeps the presidency and gets back to work passing more desperately needed legislation.

The bigger the wave, the weaker the class and the harder it will be to hold onto those seats. Democrats only have to look at their 2006 and 2008 classes for plenty of examples.

What this means is that we will likely have our third wave election in a row this year, and the bigger this one is, the more likely that there will be a countervailing wave in either 2012 or 2014.

Well, as much as I'd like to leave it there, that's not the way it crumbles, cookie-wise. As Matthew Yglesias points out, Republican gains this year are going to be coming out of a very large Democratic majority. The current breakdown is 255-177; just to reach parity, the Republicans need to pick up 40 or so seats. The Democrats are the ones that are already stretched way beyond their bounds, holding seats in all kinds of places they just never would have without George Bush's help. Many of these seats were picked up by the much-maligned Blue Dog democrats, most of which are now trapped in "who's the most conservative conservative" style battles with well-financed and typically crazy Tea Partiers. If there's ever a "natural" state to party control, these are "naturally" Republican areas, now matter how the demographics may slowly be trending. In other words, this election is the countervailing wave, and only if it's a wave of such a magnitude to tip into traditionally blue districts (a 70+ seat wave) could we reasonably expect another wave to come.*

Cook also has this to say:

Should the Senate end up with a 9-seat net gain for Republicans, or even eight, there will be immediate speculation about what Sens. Ben Nelson, D-Neb., and Joe Lieberman, I/D-Conn., do. Both are up for re-election in 2012 and neither is likely to be oblivious to the fact that Democrats have twice as many seats at risk in 2012 and 2014 as Republicans. Whether the GOP captures a Senate majority this year or not, the odds are pretty good that they will have one in either two or four years. That kind of exposure is enormously important, particularly given the rarefied circumstances in which Democrats won some of those seats in 2006 and 2008.So even if there is a countervailing wave, and somehow the House returns to Democratic control, the GOP is still going to have two more decent shots to take the Senate, where the real action is. And it's the Senate which has caused progressives the most grief in the last two years, slowing up every confirmation or bill that so much as looked at them funny. Worse yet, Senate control may lie in the hands of Ben Nelson and Joe Lieberman, two crabby old "moderates", in the worst possible sense of the word.**

So, cold water. Of course, it's possible that the Republican Party somehow deviates from its current strategy (though unlikely, considering both how much success they've had with obstructionism and how many Tea Partiers will soon be in Congress), or that legislative procedural reform is passed (also unlikely, as the Democrats will be happy to pick up those tools once used against them), and then Obama is once again capable of passing large, ambitious, and vital legislation. It's much more probable, though, that the next 4-6 years are a blur of frivolous congressional investigations, hyperbolic showdowns, and maybe even an impeachment or two.

* And keep in mind that the natural breakdown of voting constituencies has always resulted in a lopsided congressional map towards the Republicans. Democratic voters tend to cluster in higher concentrations (urban areas) than Republican voters do, so even if the congressional vote is 50-50, you'll have a Republican majority due to the way the districts are laid out.

** I wrote about this way back, but these guys get away with murder under the guise of being "independent". Remember the Cornhusker Kickback? Or, say, anything Joe Lieberman has ever done? They possess enormous power simply because they've positioned themselves at the ideological fulcrum of the Senate.

Wednesday, October 20, 2010

Always Be Foreclosing

So much the better, according to the editorial board of the Wall Street Journal. As they see things all this hysteria--the foreclosure moratorium, the fighting words from the politicians, the bloggers, always hysteria from the bloggers--is all over a legal glitch. A minor, albeit oft-repeated, technical error. Nothing to get all riled up and frothy about, Comrade.

Talk about a financial scandal. A consumer borrows money to buy a house, doesn't make the mortgage payments, and then loses the house in foreclosure—only to learn that the wrong guy at the bank signed the foreclosure paperwork. Can you imagine? The affidavit was supposed to be signed by the nameless, faceless employee in the back office who reviewed the file, not the other nameless, faceless employee who sits in the front.Totez. Leave it to the libs to make such a big deal out of something as trivial as property rights and contract law.

The result is the same, but politicians understand the pain that results when the anonymous paper pusher who kicks you out of your home is not the anonymous paper pusher who is supposed to kick you out of your home. Welcome to Washington's financial crisis of the week. (WSJ)

Here's the story:

Remember the housing crisis? Remember all of those complicated financial arrangements that bankers devised to make lending absurd sums of money to Guatemalan cleaning ladies a riskless proposition? The details don't really matter--only this general point: the dizzying tangle of unnecessary complexity that now connects a single mortgage payer to a single beneficiary of that payment is sufficiently labyrinthine to make even Jareth the Goblin King, codpiece and all, feel a little inferior.

Now with so many borrowers unable or otherwise unwilling to pay their mortgage debt, their homes (the collateral on those loans) are being seized by debt servicers (located either in the bank or outsourced to Knee-Breakers Corp.) and sold off, the proceeds going, minus fees, to investors. Hence, the Gregorian knot of mortgage payments is traced backwards to its source where it is unceremoniously cut.*

But now that process has stalled and most fingers initially pointed at "robo-signers." When a servicer forecloses upon a home, it must provide to the court (in states where foreclosures are passed through the court) a number of necessary documents--most notably, the actual mortgage note (the IOU)--along with a sworn affidavit that says something like, yes, it would seem that we actually have the right to take this person's house away.

But, alas, it was discovered that employees within a number of banks (GMAC, JP Morgan Chase, and Bank of America most notably) were processing these files at a rate of about a case per minute. That's a case examined and deemed to be in order, another foreclosure approved by the bank, every sixty seconds.

Now, here's the debate:

Is the problem simply that that the robo-pens are flying a little too quick for regulatory comfort, that the underpaid schlub in the front office was signing at the dotted line instead of the underpaid schlub working in the back? Is it, to paraphrase the Wall Street Journal editorial, that the servicers aren't certifying their right to foreclose on a property in exactly the proper way? Or is it that, in a number of cases, the servicers just don't have the right to foreclose, period?

Maybe, as many are suggesting, the servicers don't have all the necessary documentation. As the New York Times reported on October 2nd, one of the countries largest title insurers has suspended insuring sales on homes foreclosed by either JP Morgan Chase or GMAC until "the objectionable issues have been resolved." An explanation:

In every sale, a title insurance company insures that the title is free –and clear —that the prospective buyer is in fact buying a properly vetted house, with its title issues all in order. Title insurance companies stopped providing their service [to servicers trying to sell foreclosed-upon properties] because—of course—they didn’t want to expose themselves to the risk that the chain of title had been broken, and that the bank had illegally foreclosed on the previous owner. (The Big Picture)In other words, these independent private insurers are refusing to sign-off on what the minute-men robots had. And while it's impossible to know exactly what those "objectionable issues" are (the author of the blurb above seems certain, but who knows?), they're obviously serious enough to raise questions over the legality of a given foreclosure.

Recall the housing boom. The business model of most mortgage originators (initial lenders) was originate-to-sell: lend money, sell the debt to a big bank on Wall Street, repeat. This process was, it goes without saying, under-regulated and the poor standards employed by the originators are evidenced by the last three years of financial history. Further up that food chain, mortgages notes (the IOUs) were often traded 18 separate times while claims on their payments were sliced and diced and repackaged down to the cent. Given all that, it certainly seems possible that some of those notes were misplaced--or at the very least, transferred from one party to the next incompletely or improperly. To avoid this, most banks began submitting these notes to a central registry, MERS. But it turns out that the folks at MERS sucked just as bad at their jobs as everyone else in the industry. A worrying statistic:

A 2008 study by the University of Iowa showed that mortgage servicers, most often than not, were neglectful in their storage of original documents that will support foreclosure. The study showed that out of the 1,700 cases of bankruptcy due to home foreclosures, 40 percent have missing original mortgage notes and other required documents. (Real Estate Pro Articles)

Now understand that within the under-regulated complex of industries called Modern Finance, the debt servicing sector stands out as one of its least regulated cogs. With little supervision, the incentives facing servicers are largely skewed towards foreclosure. An example: when homeowners stop making their payments, all existing financial arrangements pertaining to that debt enter a kind of legal limbo. Investors owning securities backed by the mortgages are entitled to their monthly payments and property taxes and insurance must be paid on the property after the first 90 days of delinquency. The servicer must cover these costs until the property is sold. Furthermore, most servicers are paid additional fixed fees to cover default and foreclosure expenses. With so many reasons to foreclose, it would thus appear that the assembly-lines lenders like Countrywide adopted during the housing boom are being re-assembled--in reverse.

And with the attempt to constantly churn out as many foreclosures as possible, like the attempt three years ago to constantly churn out as many mortgages as possible, comes the predictable fraud. Meet the new crisis, same as the old crisis:

Last year, the Department of Housing and Urban Development (HUD) received nearly 2,500 complaints about servicers, a 379 percent increase over 2007. In the first 10 months of 2009, consumers filed about 1,000 legal complaints against 10 of the largest servicers for illegal foreclosures and other predatory practices...A federal class-action suit against Ocwen asserts that it has hiked mortgage payments without fair notice, forced borrowers to buy unnecessary insurance, and intentionally processed payments late. (Mother Jones)

Unmentioned here (and on the editorial pages of the Wall Street Journal and on CNBC) is the wide-spread assertion that, in the absence of valid documentation, many servicers working on behalf of banks or bank-managed trusts simply filled in the blanks. As in, they would just make shit up. Exhibits 1, 2, and 3.

So here's the up-shot:

There has been a systemic breakdown in the national foreclosure process. What some are still trying to call a series of technical errors in actuality represents the untethering of an entire subsection of American Finance from the rule of law and property rights. Blatant fraud aside, many foreclosures seem be taking place based not on legal contract, but on the word of the servicer and the complacency and legal ignorance of the borrower. Shoddy paperwork becomes much more than just shoddy paper work when you are discussing the institution of property rights as it pertains to a 2.6 trillion dollar industry. State attorney generals and major investors are only waking up to that fact now. That is the crisis.

On one end of the broken chain of title sits a class-action law suit waiting to happen in every former homeowner who might have reason to believe that a single detail on their mortgage note was violated, plus a growing army of angry borrowers grinding the foreclosure process to a halt.

On the other end of the chain, sit the investors. Imagine this: back in '05 or '06' or '07, an investor buys a financial product offering a certain amount of cash, sliced off from a thousand different mortgage payments from a thousand different counties around the country. With the meltdown, most of those mortgage payments stopped coming. Now, as the investor waits for foreclosure to squeeze the last dollars out from a disappointing stream of payments, that investor learns that the trust that sold him the security never legally owned the underlying mortgage notes. Hell, maybe those notes were sold simultaneously to three separate banks! So now the investor, and every one of his/her counterparts, wants the principle investment back--right now and with interest too.

So what does the trustee say? We can't be entirely sure in all cases, but the blog Rortybomb gives the following real-world example of a contract between the original underwriting of a pool of mortgages (in this case Goldman Sachs) and the company that bought the pool to slice and dice for investors (in this case Deutsche Bank):

In connection with the transfer and assignment of each Mortgage Loan, the Depositor has delivered or caused to be delivered to the Trustee for the benefit of the Certificateholders the following documents or instruments with respect to each Mortgage Loan so assigned:

(i) the original Mortgage Note (except for up to 0.01% of the Mortgage Notes for which there is a lost note affidavit and the copy of the Mortgage Note) bearing all intervening endorsements showing a complete chain of endorsement from the originator to the last endorsee...In the event, with respect to any Mortgage Loan, that such original or copy of any document submitted for recordation to the appropriate public recording office is not so delivered to the Trustee within 180 days of the applicable Original Purchase Date as specified in the Purchase Agreement, the Trustee shall notify the Depositor and the Depositor shall take or cause to be taken such remedial actions under the Purchase Agreement as may be permitted to be taken thereunder, including without limitation, if applicable, the repurchase by the Responsible Party of such Mortgage Loan. (Rortybomb; emphasis his)

Get that? If any more than one in ten-thousand of the underlying mortgages notes is missing or improperly endorsed, the second bank can force the first to buy everything back. And the originator can't go back and fill in the blanks now, assuming it would be able to do so, because it had 180 days after the purchase date to do that. So all those banks with all those toxic assets sitting on their balance sheets? They might soon find themselves having to make bit more room.

This isn't solely a theoretical possibility. Just before writing this, I found this via Ezra Klein:

The Federal Reserve Bank of New York has joined a group of investors demanding that Bank of America buy back billions of dollars worth of mortgage securities that are plagued with shoddy documentation and lending standards, according to people familiar with the matter...If Bank of America refuses to comply, these investors could end up suing, a person familiar with the matter said.(Washington Post)

And never fear an insufficient number of reasons to feel fear, Felix Salmon has identified a related clusterfuck-in-the-making. This one involves investment banks potentially withholding material information from investors to whom they were selling these mortgage backed monstrosities. Which aside from not being a very gentlemanly thing to do constitutes insider trading and could serve as a solid basis for litigation--either from the SEC or any number of pissed-off investors. Or both. Oy.

With the sins of the mid-oughts potentially coming back to wreak havoc upon the balance sheets of the big banks, a number of people are predicting another full-fledged financial crisis. And this time around, it's hard to imagine any policy maker with the stomach for TARP II. For no particular reason though, I doubt things will get that apocalyptic. Maybe I'm just having a hard time imagining the big banks not finding a way to legally or politically slither out of another existential crisis. What I don't doubt is that with major financial interests opposing the banks on the so-called "buy-side," this problem isn't going away anytime soon. A month or two or three from now, if we're calling it anything, I'm guessing that we will no longer be calling this the Foreclosure Mess (or gate or crisis), but something more along the lines of Pissed-Off Investor-Gate or the There Aren't Enough Lawyers in Hell to Deal with All These Lawsuits Crisis.

But down at the ground level, I suspect that maybe a few high profile cases will bring down a particularly flagrant servicer or two--and with it, the entire foreclosure fraud issue as a publicly recognized scandal. Unless the poor paperwork was so bad as to actually invalidate existing debt (which is not going to happen and if it did would open a whole other can of worms), I have a hard time believing that the servicing and foreclosure system will suffer much more than a few aftershocks. Without regulation, the sector will remain in the shadows. And all those deadbeat defaulters that nobody cares about, without the indignation of a defrauded mutual fund or national government to back them up, will remain deadbeat defaulters, even when they aren't. In the meantime, let's all pray to Saint Elizabeth Warren.

*It is worth mentioning that in all the chatter about fraud and abuse, few are questioning the economic logic of foreclosing at all. Rortybomb has a great post on this.

Tuesday, October 19, 2010

New Age idiots kill people, puzzle over declining business

“It was a very unfortunate and sad situation that could have happened anywhere,” said Janelle Sparkman, president of the Sedona Metaphysical Spiritual Association, who attributes the woes that New Age practitioners are experiencing to the lack of disposable income tourists have for spiritual needs and not what happened that awful afternoon. “It was not indicative of Sedona or Sedona’s practitioners at all.”Uh... what? Three people could have died in a sweat lodge anywhere? I mean, I guess that's technically true. I mean, I don't think that the physical location of the sweat lodge made it more dangerous. If this asshole was charging 10 grand to sit in a sweat lodge in downtown Baltimore, they could have died there, too. But how the fuck is this not indicative of Sedona? Have you seen the Wikipedia page? It has a separate heading for vortices. Seems to me that, given the amount of bullshit that comes out of that corner of Arizona on a daily basis, it's probably a lot more likely that it would happen in Sedona. And for fuck's sake, one of Sedona's most well-known practitioners killed three people. If that doesn't say anything about Sedona's practitioners... Well, it does.

“Initially, I didn’t think it was going to affect business and, a year later, I know I was wrong,” said Deidre Madsen, who runs a New Age travel company in Sedona and a Web site devoted to inner growth. “I’m shocked at the impact. My business is down 20 percent.”You're shocked at the impact. Of three people dying. You're shocked. You know, just because you believe that those three people are going to be reincarnated as rainbow dolphin angel faerie babies doesn't mean that everyone does. When people die doing something, other people don't want to do it anymore.

Guess what? If you didn't want that "energy," you shouldn't have killed three people. You could have listened to the people warning about the dangers of sweat lodges, but you didn't. You went ahead, because you are goddamn greedy fucking vultures,* irregardless of whether or not you believe in the shit you peddle. Yes, IRregardless. I'm so fucking pissed I added a syllable.“We do not want an energy that we’re sitting on a graveyard,” said Amayra Hamilton, co-founder of Angel Valley. “This is about learning and appreciating life. That means expanding our understanding of life and death.”

Now, to end on a lighter note, here are the first couple paragraphs from the article:

So deliciously sardonic. Kudos to you, Marc Lacey.SEDONA, Ariz. — There is negative energy in the air here, which the channelers, mystics, healers, psychics and other New Age practitioners of Sedona are grappling to identify and snuff out. It has to do with the recent dearth of visitors to this spiritual mecca in search of help.

Nobody is sure exactly what is keeping people away from Sedona’s four vortexes, those swirling energy sources emanating from the earth, but the effects are clear: far fewer crystals are being purchased, spiritual tours taken and treatments — from aura cleansings to Chakra balancings — ordered.

* Ray refused to refund his customers' money after he canceled the retreat following the deaths.

Friday, October 15, 2010

Vote on my Vote

Here's the issue:

I have a ballot. It's an absentee ballot. I got it in the mail. There are ten pages and I have completed them all. From the federal level all the way down to the city, I filled-in the requisite number of broken arrows such that my infinitesimally marginal voice will be projected as loud as it can be projected. I have researched those judges looking to represent my municipal district despite an absolute dearth of relevant googleable information. I have dug deep into the comment sections of San Francisco's alternative weeklies and unearthed dirt on local school board candidates. I have figured out what an Assessor-Recorder does. But one vote remains.

Well, technically two. California state propositions 20 and 27 are opposing measures on the same issue. The issue is redistricting. The text of Prop 20 reads as follows:

Removes elected representatives from process of establishing congressional districts and transfers that authority to recently-authorized 14-member redistricting commission comprised of Democrats, Republicans, and representatives of neither party.Prop 27 reads (allow me to paraphrase): makes Prop 20 go away, no tag-backs.

If both props carry a majority (I wouldn't put it past the California electorate), the one with the most votes wins.

As far as my principles go, I'd really prefer to vote for 20 and against 27 (that is, for the redistricting commission). As far as I can tell, gerrymandering doesn't serve any social function other than to keep incumbents in power. Also, its a fantastically effective tool to disenfranchise any residentially-concentrated minority community (see: the Spanish-speaking half of the state). Allowing a commission (selected to fit the above mentioned criteria by three state auditors, a Democrat, a Republican, and an independent, all three of whom have already been selected, also randomly) to redraw congressional districts is obviously less democratic in a direct sense, but strikes me as a little more fair and a little more legitimate.

So why do I hesitate? This is what I wrote to my mom about the same issue late last night:

But, on the other hand, why should a consistently Democratic state be diced up by a panel divided equally along partisan lines? And do we really want to take redistricting power away from our elected representatives, however noble we happen to think the idea is, when OUR elected representatives are predominantly Democratic? Do we want to be unilaterally principled when our votes are competing with (gasp!) TEXANS?!? Have you ever seen a map of Texas, district-by-district? Most people don't know this: it's a pixel portrait of Tom Delay's face.A number of people in the pro-27 camp make the argument that while reforming the redistricting process is a worthy goal, it really ought to be done on a federal level. Otherwise, all those states most open to transparency and electoral reform (can I fairly assume these to be disproportionately blue?) will vote themselves into an electoral disadvantage against those that hold out against reform.

But can we ever really expect a law so hostile to incumbency to pass through Congress?

So what do you guys think? Imagine you're from California and then imagine that your vote makes the slightest difference. Do you vote on your principles or your partisan pragmatism?

Tuesday, October 12, 2010

Interesting things!

1. This is a great article on the process of acquiring medical marijuana in America's most competent state. Basically, it's easier to find a fake doctor to prescribe weed to you for your fake problems than it is to get a real doctor to agree to do the same for real problems.

2. NYT Review of Books on the drug war in Mexico. I don't have a lot of "value-added" commentary here, other than to say that this only reinforces the argument I am constantly making about the moral costs of cocaine use by Americans, Canadians, and Europeans. Also, while this is an incredibly dark and disturbing article, there are repeated references to a criminal death cult, which means that Cobra was a much more prescient movie than I am willing to admit.

3. A new language! Well, not new, but not known academically. It's also interesting because linguists aren't really sure how Koro has survived so long, considering there is no place where it is the dominant language.

4. An interview with Steve Rattner, the dude Obama czar-ified to help work out the auto industry bailouts. I confess I didn't really understand this portion of TARP, nor did I pay a lot of attention to it, but, as with the rest of the bailouts, it seems to have gone smoothly. What is most interesting about the interview, though, is the volume of spleen-venting Rattner does over Congress. He even makes two criticisms which have been around in the liberal blogosphere at least as long as Obama's been in the White House (and with which I happen to agree): one, that the presidency is weaker than the media perceives or portrays it to be (at least in domestic affairs), and that as a result negative attention that should rightly be cast towards congress is cast towards Obama, and two, that the congressional appointment system is totally screwed, to the point where even a Nobel Prize-winning economist can be kept out of the Fed.

Sunday, October 10, 2010

Just a quick thought

Scott and I often discuss the ethical implications of robots. Perhaps surprisingly given our respec-tive poli-tics (try to guess who's who!), we actually agree on a lot of it. We both think that a computer brain that is indistinguishable from a human brain without cutting into it (i.e. a computer that can pass the Turing Test as consistently as a human can) must receive the full legal protection afforded to humans, since it would be impossible to state confidently that such a computer did not possess something that is equivalent to how we define human consciousness.* From this perspective we've had several quite enjoyable conversations on the topic.

Anyway, I was absently thinking about this last night (or Friday maybe) and it occurred to me that the Three Laws from Isaac Asimov's universe, which are by law written into all code in robot brains and have actually become a sort of standard among real-world roboticists working on robot AI, can perhaps be thought of as being analogous to implanting human brains with devices that block certain thoughts - i.e. complete mental censorship. If the robot can't even imagine harming a human, its mind is irreversibly handicapped by censor.

I found that idea abhorrent. To me, there can be absolutely no situation in which any body, individual or government, can have the right to restrict thought, by which I don't mean "ideas" or anything like that, but rather the actual thoughts that live in our heads. That is, the government has no right to tell a Klansman that he can not dream about lynching a black man, nor a rapist from fantasizing about rape, nor a pedophile about sex with minors. Obviously the government has every right and obligation to tell them that they are not allowed to do those things, and perhaps even that they are not allowed to speak about it in certain contexts (such as a Klan rally). But anyone is always and forever free to think whatever they want. To give a real world connection to this, I am adamantly opposed to mandatory chemical castration for sex offenders for just this reason (as California decided it would do in 1997 - several other states have since followed suit). It's a wonderful thing that chemical castration is possible, so that the "good" pedophiles,** who are aware of their attraction to children but are also aware that it would is morally abhorrent to act on their urges, can find relief. But I can simply not agree with mandatory castration on the grounds that it artificially restricts one's freedom to one's own mind.

So that brings me to my question:

Do you fellas and lady believe the same way I do that people have an eternal and inalienable right to think whatever they want within the confines of their own head?

And, of course, if you want to comment on any of the robot stuff, go right ahead.

* Incidentally, I also think that certain animals (probably some whales and dolphins, and possibly [though it's a stretch] some of the more advanced cephalopods) deserve similar protection, but the data to back that up is far from conclusive, so I reserve my moral outrage at killing them to the "but they're so cute!" stance. Well, not the cephalopods.

** And, of course, "good" rapists, who are aware that they are aroused by the thought of non-consensual sex but know it is morally abhorrent, and "good" other sex offenders. It's just a lot harder to write the phrase "good rapist" even with scare quotes then it is to write "good pedophile," because a rapist is someone who's already raped, whereas a pedophile (by my own definition, at least, I might be wrong) could just be someone sexually attracted to children, regardless of whether they've acted on that before.

Friday, September 17, 2010

Decisions, Decisions

Over the past six months of deciding "What To Do With My Life and How To Make the Right Choice," I've been obsessively "self-aware," trying to factor into my decisions not only the apparent utility and costs of each option, but also the various subconscious assumptions and social pressures that have led me to evaluate each pro as a pro and con as a con. All the time I have comforted myself with the behavoiral economic/social psycological/consumer ideological assumption that the more I struggle to make the choice, the more I will subconsciously justify it in the end, releasing endorphins, creating happy receptors, and probably moving me one step closer to the Buddha.

However, if I have learnt one thing over the last year or so since graduation, it's that the worst choice one can make is none. On days when I haven't left the house, I have spent hours being anxious about all of the things that I could/should/would otherwise be doing, while failing even to finish mundane tasks such as laundry or email-responding, for fear that they might keep me homebound. Wasn't I pleased to learn that this phenome-not is being throughly studied at MIT and, most particularly, the RSA:

"The Paradox of Choice" - Rene Salecl

If you don't have half an hour to burn, Salecl's basic premise is that when faced with an abundance of choices, we imagine the costs of each choice to be much higher, become anxious about choosing anything, and fall into a state of capitalism-induced passivity.

It seems to me the paradox goes one step further - we justify what we have chosen to self-satisfaction only if we do not recognize the other options. That is, we are comfortable having spent $300 on the X-box so long as we don't think about how many textbooks we could have bought with that money (4), or meals for starving orphans in Birundi (700). On the other hand, if someone challenges our choices by presenting such options (sorry), we will often over-justify (radicalize) or refuse to make a choice in the future, depending on...(if protons were people the Bomb would work only on sunny days ending with q).

Salecl continues: under Capitalist systems, people refuse to organize or take real action themselves, and are prone to leaders who seem unduly confident (which is usually a symptom of mild to acute psychosis).

Which brings me to Mr. Glenn Beck.

"In his interview with Newsmax, Beck reveals his worst fear: that a “Reichstag moment” — a catastrophic event may soon take place so that the powers that be in Washington can end the Republic and our cherished Constitution." (glowing book review here)

"First they went for the Tea Party Protestors, and I was silent..."

On better days, I believe that Beck actually sees the similarities between American Libertarians and the Communist Party before Hitler and Stalin. On the worst days, I fear he doesn't realize the difference.

The key irony of Soviet-style countries was that the state got stronger instead of dissolving. It could never dissolve. By teaming up with the Tea Party, the Libertarian movement (distinct from the Libertarian Party) found itself a strong, popular base. (Read Jane Mayer's account in the New Yorker - brilliant despite its air of conspiracy theory). However, this base demands social legislation (abortion and gay marriage being the most prominent) that conflicts with the very principle of an unregulated society. By supporting a vague social ideology, as opposed to an overwrought Socialist (economic) one, the Tea Partisans are following their vanguard back to a Gilded Age of poverty, horrible injustice, and classical economics.

I have to laugh (having considered the other options), and hope this all blows itself apart. If it weren't for all this Captialist-passivity, I'd be at the next Tea Party rally with the rest of the psycho-Patriots, waving my sign promoting kitchen abortions, bald eagle spearing and forced sodomy (privately funded, of course).

Wednesday, September 1, 2010

The Fed Isn't Dead

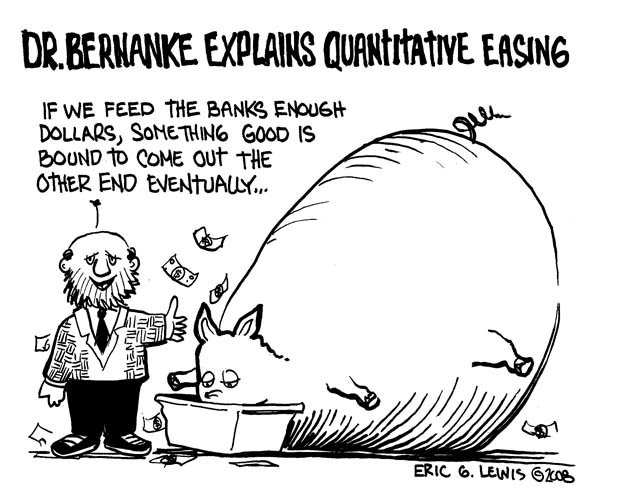

But wait a minute, you might be saying if this interested you in the slightest, isn't the Federal Reserve out of gas? Haven't they done all that they can do? Having pushed down short-term interest rates on government debt about as low as it will or can go and having, in the meantime, swelled its balance sheet to an unprecedented level, isn't it's proverbial powder all soggied-up (or shot out, whatever you think is more appropriate to the context)?

I don't know, but Paul Krugman and a bunch of other people are mad. In fact, they're basically calling Ben Bernanke a pussy. So what's a central banker to do?

The most traditional approach would be to simply re-start what the Fed already did last year; to expand the range of assets the Fed will buy or otherwise deal with (from longer term U.S. government debt all the way out to financial toxic waste) and to re-open a lot of those fancy lending and asset buying facilities. There are an alphabet soup's worth of them, and they aren't really worth getting into because, fundamentally, they all serve the same purpose. Either through loans on rediculously easy terms or through the purchase of somewhat riskier assets, the Fed hands over to the banks (and a few other bankish things) a lot of cash. And if these banks have more cash, so the logic goes, they'll be less likely to sit on it and more likely to lend it out for, one can hope, productive, economically stimulating, purposes. Or they'll just use it all to lend back to the federal government which will in turn be prevented from spending it by Congress. But who's counting?

But, according to Nick Rowe, the particular menu of assets that the Fed decides to start devouring is not just about range, (i.e. how much more stuff it buys or how much risk it's willing to take on), but whether the particular assets in question are "pro-cyclical" (i.e. people tend to want and buy them when the economy is doing well and not so much when the economy is not so much doing well--think most stocks and, particularly this time around, houses, and, on a personal level, filet mignon) or "counter-cyclical" (think U.S. government debt, maybe gold, and McDonald's). Right now and traditionally, the Fed focuses on buying the most counter-cyclical of all counter-cyclical assets, short-term U.S. government debt. It's considered safe and it's ubiquitous as all hell--that's why the Fed deals in it. But, according to Rowe, that's exactly the wrong kind of asset to be buying now.

Suppose the Fed buys a counter-cyclical asset. If the price rises, people may interpret that rise as a sign that monetary policy is having the desired effect. Or they may interpret it as a sign the economy is getting weaker. Depending on how people interpret the rise in price of the counter-cyclical asset, and the relative strengths of the direct causal effect...the net effect on the economy is ambiguous....Suppose the Fed buys a pro-cyclical asset. If the price rises, people will interpret that as a sign that monetary policy is having the desired effect. Or they may interpret it as a sign the economy is getting stronger. Both effects work in the same, desired, direction. Also, if people thought that monetary policy was having the desired effect, and was not impotent, any increased optimism about the future path of the economy would tend to raise the price of the pro-cyclical asset still further, which would tend to make monetary policy look more effective, and reinforce that optimism. (Worthwhile Canadian Initiative)A bit more interesting to me, and a whole lot less likely, is the suggestion of junking and then rebuilding the entire way way in which monetary policy is conducted. As I mentioned before, all the money that the central bank hopes to push into the economy through an expansive policy is funneled through the banking system. In short: federal reserve gives cash to/buy something from a national bank, and then the bank feels a little bit freer to do the same to you and me. The obvious catch, however, is that it doesn't matter how much cash a bank has, the 0% return offered by cash (or the slightly higher yield offered by a loan to the U.S. government) beats the hell out of the expected return from you and me, because you and me are both unemployed and over-indebted. I mentioned this back in January.

Also, to the extent that Rowe and others talk about the influence of higher asset prices on inflation expectation (i.e. how people respond in their spending and investment behavior to an increase in prices), the respective directions of the financial markets and of the economy at large seem prone enough to dramatic divergence (at least for longish periods of time). Which is to say, even if stocks are up, that doesn't mean we all get our jobs back.

So here's an idea from Interfluidity: rather than relying on the financial sector to serve as a conduit, why not approximate Milton Freidman's helicopter drop by simply depositing chunks of cash in the bank accounts of citizens across the country. Yeah, just like that. Give money away. For free.

That is, rather than trying to fine-tune wages, asset prices, or credit, central banks should be in the business of fine tuning a rate of transfers from the bank to the public. During depressions and disinflations, the Fed should be depositing funds directly in bank accounts at a fast clip. During booms, the rate of transfers should slow to a trickle. We could reach the “zero bound”, but a different zero bound than today’s zero interest rate bugaboo. At the point at which the Fed is making no transfers yet inflation still threatens, the central bank would have to coordinate with Congress to do “fiscal policy” in the form of negative transfers, a.k.a. taxes.(Interfluidity)How would ensure an equal distribution of transfers? Would this create accounting issues for the Federal Reserve? What would be the optimal amount and how would we prevent people from abusing the system? The blogger, Steve Waldman, tries to address the practical questions, as if anyone would really humor the idea, or, more likely, just for the coherency the argument; it's a thought experiment for its own sake.

Which, for the time being, is what all of this is. In his last speech (which I didn't read; I'm boring, but not that boring), the Chairman Ben himself claimed that should the economy need additional help, the Fed would be willing to provide it. What that assistance would look like (and more pressingly, what an economy in need of help looks like the Fed) is, of course, just a matter of speculation.

Friday, August 20, 2010

Wednesday, August 11, 2010

Saskatchewan should keep the bullshit on the wheat fields*

Zamboni is also getting attention from neurologists and MS specialists, who remain skeptical because Zamboni’s claims run contrary to years of research and thousands of studies pointing to the current model of MS as an autoimmune disease.Novella also points out that it's possible the vein stuff is merely a symptom of the disease which could itself lead to a worsening of the other symptoms. However, the vast majority of the research (19 studies, "a pittance") comes from Zamboni's research team himself. Of the four published studies by other researchers that have tried to replicate his theory that MS sufferers have venal blockage, only one has found a significant difference between the veins of MS sufferers and non-MS sufferers.

The stories in the Globe are basically a collection of anecdotes from MS sufferers who usually "know someone" who underwent the therapy and felt a lot better after:

“I still have patches of numbness, those things won’t go away,” said Duncan Thornton, a Winnipeg resident who travelled to Poland for the surgery in March. “But I have more energy than I’ve had for 20 years. I can play with my kids, I can stand up and do dishes, I can live life like a normal parent.”or sufferers who feel that the government is keeping a promising therapy from being offered to them:

“It’s our bodies. The government should let us see for ourselves if it works,” she said at a small gathering with other MS sufferers. “They want us to wait a few years, but this illness won’t wait. We see this as a way out, the only way out."MS is, of course, a terrible disease, and all hearts go out to its sufferers. Unfortunately, there's a reason that there are people who go through four years of school and four years of training: it's because, contrary to popular belief, your average person doesn't know what's best for their body. Doctors do. Luckily, the Globe stories have done a fairly good job of keeping Big Pharma conspiracy theories off the pages, but this opinion piece (and a quick Googling) show that they are, of course, alive and well.

Unfortunately, none of these things are in any way scientific justification for the course of action Mr. Wall has steadfastly dedicated himself to: for fuck's sake, look at this quote from Mr. Wall in a July 28 story:

“I heard some stories in church,” he said from a caucus gathering in Saskatoon. “One member shared some stories of a spouse struggling with it and it really stuck with me.”Um, excuse me? You heard some stories? In church?? This is how you make important decisions about healthcare? Mr. Wall has been framing his decision in many of the terms that purveyors of quackery use: the therapy is giving people "hope," the procedure is "controversial," people "deserve answers." None of this means anything, of course, because the way to give people hope and answers when it comes to controversial therapy is to follow the scientific method. The basic proof-of-concept that underlies rigorously funded clinical trials isn't even close to being there - Zamboni's results have been replicated (in reputable scientific journals, that is) by only one other researcher and three have failed. I'll leave it to Novella to close out:

My open plea to the MS community, especially those who are going down the rabbit hole of conspiracy theories, is to keep this discussion about the scientific evidence. This is not the place for cheap conspiracy theories. I fear my plea will fall on deaf ears, but it never hurts to ask.

* OK, that title might be a little harsh, but I just woke up and it was the only mildly clever thing I could think of.

Monday, August 9, 2010

Links links links

1. Ben sent round a previous episode of this RSA Animate series. I know that there are varying degrees of Zizek love amongst us (I myself am not always enamored), but this is certainly a thought-provoking lecture, if maybe a little overboard at the end.

2. I would guess you had all read this by now, but if not, George Packer's article on the American senate and its utter collapse is real good. It's a topic we all often pull our hair out about, but on top of all that Packer is just a really good writer and I have linked to articles of his before.

3. Ezra Klein just linked to this, and it is hell of dry, but if you like your explanations of the roles of the President's economic advisors like you like your martinis, then this is worth reading. The most informative part is the hypothetical NEC Gas Tax meeting, which does a good job of explaining a) who the heck all these people are and b) what the heck they're all doing in the White House.

That's it. I wanted to share, but I don't have much to add, so there.

Saturday, August 7, 2010

On Freedom and its Composing Parts

Not to pull a Sol here, but this:

Not to pull a Sol here, but this:The silly controversy over the downtown mosque is excellent evidence that the conservative movement has become obsessed to the point of derangement with a right-wing version of identity politics that sees everything through the lens of the assumption that American identity is under seige. The modus operandi of the populist right is patriotic semiotics gone wild. 9/11 was a Great Awakening and Ground Zero is a sacred scar representing the sacrifice of those thousands who died in fire in order to shake the rest of us into recognition of the great existential threat to the American Way of Life. To refuse to resist the placement of a mosque next to the grave of those martyred in the Great Awakening is to fail to have heard the call, to fail to understand the battle now underway, to complacently acquiesce to the forces slowly transforming America into something else, into something unAmerican, a place for some other kind of people, a place not worth fighting for. It is to, as they say, “let the terrorists win.”As Wilkinson notes, this mosque debate (which I assume we are all at least somewhat aware of) is more revealing of Culture War pathologies than it is informative or rationally constructed. More than any other part of the Culture Wars of the last two decades, except maybe the Prop 8 battle, the whole uproar shows that modern American conservatism is much more an identity than an ideology, an identity that worships and fears for a romanticized idea of American liberty. The tenets of religious liberty and property ownership are supposedly uncontroversial parts of American civic thinking, but to conservatives they are actually subservient to this concept. Liberals see these things as fundamental building blocks, without which American freedom doesn't exist, and therefore as important as the "freedom" itself. Conservatives are much more concerned with American freedom as a thing under attack, that needs defending, that cannot possibly flourish without vigilance, the kind of vigilance that may actually require subversion of those underlying principles. While someone who saw religious freedom as a core part of American liberty would be forced to cede that, even if they found Muslims repellent, they simply could not deny them a right to pray where they want, there is no such deference to principles within mainstream conservatism on this issue. Instead, it is the thing itself that is of utmost importance, not the things necessary to make and sustain it.

The same principle is in play in the gay marriage debate. Individual liberty and the right to pursue one's happiness are fundamental building blocks of the American system. The right to marry who you love, especially when it won't affect any other person in your community, is in accordance with these principles. But gay marriage seems to strike at a fundamental part of Americanness, as identified by social conservatives, this thing which is perpetually under assault.

What's truly frustrating, to me, is that opponents of either Lower Manhattan-based mosques or of gay marriage must then reach out to logically incoherent arguments to put some window dressing on their otherwise emotional reactions. I had dinner a few nights back with some folks, just after Prop 8 was overturned, and one of the people there said she opposed the repeal because she expected a future in which churches would be routinely sued by gay couples for refusing to marry them. When I pointed out to her that, like straight people, gay people probably don't want to force someone to marry them, and would rather have a nice, voluntary set-up, she told me that "Americans sue over everything", like "hot coffee on their laps", and that this would be no different. Now, I don't know how conservative she may be in all things, and we didn't really go far enough in the conversation, but there really isn't a lot of sense in this point. Churches that are hostile to gay people are highly unlikely to have gay people in them. I know that were I gay, I wouldn't want my officiant to sulk through the whole proceeding, under threat of lawsuit. Alternatively, the implication may have been that conniving heterosexual people could manipulate their rights to squeeze money out of churches that don't want to marry them, but there's a good chance that they would just be married anyway, and their elaborate plan would backfire.

I realize that, as a liberal person, it's very tempting for me to dismiss opposing arguments as pathological, or emotional, rather than rational. I usually try to avoid that kind of thing because it can just as easily be leveled at me: I know and like Muslims, I know and like gay people, and I want them to have the freedoms I have. But it's been hard, in the last, oh, let's say 7 years, to look at the Culture War and not come away profoundly cynical about the depth and philosophical rigour of social conservatism. Everything always boils down to a variation on the same theme: Here's America, here's freedom, here's a threat, and here's how we must defend freedom from itself. No matter that the threat itself is a feature, not a bug or a foreign virus, of the democratic system, and no matter that by considering it a threat, you're actually being threatened by what you seek to protect.

Thursday, July 22, 2010

At Their Discretion

Essentially, I've been trying to figure out what's actually in this bill and what it will all mean. Indirectly, of course. That is, I'm only assessing the assessments. It's not like I get paid for this. So anyway, here is my tremendously unsatisfying analysis: it is impossible to know what it will all mean.

If you've read any other commentaries on the bill so far, you've probably come across this same conclusion. By and large, what the bill sets about to do is to repair, tweak, and lubricate the American financial regulatory machine. Congress, it can be said, has given the bureaucracy a whole new set of fancy tools. What the bill does not really specify in most cases is how (or even whether) those tools get used.

So how does one interpret this? One could very easily don the rose-colored glasses and imagine a future in which this regulatory machine is manned (or in a particular news-grabby case, womaned) by those who both know and want to run it at full capacity. Or one can with, unfortunately, a much tamer imagination, don the glasses of recent history (which are certainly not rose, but beige, and flecked with the crystallized salt streaks of teary disappointment), and imagine a not so different future in which regulators ignore all the buttons upon their re-vamped console except for the one labeled "auto-pilot."

So here are some specifics (the sources I used are all at the bottom):

- First of all, and probably most consequentially, a new panel (the Financial Services Oversight Council) will be set up to figure out exactly which financial institutions fall under the new regulations and which do not (that is, which are "systematically important"). It will also review the overall stability of the global financial system. Presumably this crack team of top regulators will be able to identify problems as they arise and then act upon them in some such way. Kind of the like the Fed was always expected to.

- New regulations on capital levels (the quantity and quality of readily accessible "cash" banks have to hold on hand for a rainy, or panicky, day) are going to be implemented, the bill assures us. They will be drawn up by a panel of regulators who will presumably know what it is they're doing. No absolute numbers included, but current levels are set as a floor (and interestingly, the levels, the new law states, should expand and contract with economic activity.)

- Banks with government guarantees are restricted in the degree to which they can invest their own money for the financial return of the bank itself (this is the Volker rule); that is, acting like a hedge fund. The restriction is fairly liberal though (so I've read anyway), so the effect might be minimal.

- A new set of head-slappingly obvious but (maybe necessarily) vague restrictions are placed on the mortgage industry (e.g. you can't lend someone money if you aren't reasonably convinced he or she can pay you back).

- The ability of the government to seize, chop up, and liquidate problem institutions will be expanded to include non-banks. Which non-banks? Presumably companies like AIG and Lehman Brothers were in mind when this provision was put in, but I'm not sure. I've tried to figure it out. Either way, in the event that a "systematically important financial institution" has to get seized, the pool of money required to pay off their debts is not pre-funded, but may be borrowed from the Treasury, to be repaid subsequently by the financial industry as a whole with one-off, retroactive tax. Kablamo.

- A Consumer Financial Protection Agency is set-up. How much it does and how effectively it does it all depends on who the regulators are. It's potential authority seems broad, as far as I can tell though. A Tea Party's Czar to end all Tea Party Czars.

- Securitization is rationalized slightly. Any bank that tries to pawn off that hottest new pool of mortgages has to keep 5% of the thing on its books. This could potentially be a pretty big deal, though a major exemption exists for "qualified residential mortgages." Who makes the determination? The ever-watchful regulators, obviously.

- Rating Agencies, rather than being allowed to issue their ratings as opinions and thus under the protection of the 1st Amendment, are made liable. In other words, they might actually have to start doing their jobs. There are already some aftershocks on this one.

- Any firm that enters into a derivative contract will be forced to set aside some collateral and extra case, "just in case." Standard derivatives will be forced through clearinghouses (where an independent body makes sure both sides of each deal have their ducks in order) and then (as far as I can tell) onto an exchange of some sort (where the price of each standardized contract will be public to anyone. As for the riskier types of derivatives, regulated banks and non-banks will not be able to hold them directly. Instead, the interested party will have to set up a separate (isolated, funding, financial and legal liability wise) corporation, which it must nestle upon a pillow of "just in case" cash. All in all, this could be pretty good except for the fact that key terms such as "risky," "standard," "independent," and "appropriate collateral" will all be determined by...you guessed it...regulators.

So to re-articulate: the new regulatory order really has both the potential to surprise and to disappoint. And yet I worry. Finger-wagging ever impatient libs who seem only too eager to knit-pick Congress' latest Obama-approved watered-down compromise, Matthew Yglesias reminds us that "this regulatory setup, like all regulatory setups, only works if the regulators want it to work and that only happens if politicians want the regulators to want it to work."

Sure. A law only gets enforced if the cop wants it enforced. But why leave so much discretion to the cop?

Tuesday, July 20, 2010

Less-than-stale-toast

Friday, July 9, 2010

On My Fears Upon Returning from Asia

The times they are a'changing. From the New York Times:

The increasing emphasis on more advanced skills raises policy questions about how to help low-skilled job seekers who are being turned away at the factory door and increasingly becoming the long-term unemployed. This week, the Senate reconsidered but declined to extend unemployment benefits, after earlier extensions raised the maximum to 99 weeks.

The Obama administration has advocated further stimulus measures, which the Senate rejected, and has allocated more money for training. Still, officials say more robust job creation is the real solution.

But a number of manufacturers say that even if demand surges, they will never bring back many of the lower-skilled jobs, and that training is not yet delivering the skilled employees they need.

In other words, the changes in the U.S. labor market are structural and long-term. The miss-match between what the majority of companies want out of their workers and what the majority of workers can offer isn't going to resolve itself in a hurry.

From some economist on some blog:

There is long-run structural change going on in the US economy - including a shift from manufacturing to services, and a shift in demand from low-skilled to high-skilled labor. We're all aware, I think, of the increase in the wage gap that developed 30 or so years ago between college-educated workers and those with less education. The housing boom masked some of what was going on, as it absorbed a lot of low-skilled workers. With the collapse in housing construction, we're stuck with the fallout - what some would call structural unemployment - which is making the unemployment rate higher than it would otherwise be.And higher than it would otherwise be is probably where it will stay for the next decade or two.

Monday, July 5, 2010

America's Hat Also Has a Stupid Senate

The Senate is working quickly through many of the bills that were passed by the House of Commons in recent weeks but one controversial piece of legislation seems to be stalled.And guess what? It's been lazing around Ottawa since 2006!

Bill C-311, drafted by NDP MP Bruce Hyer, would require the government to cut greenhouse gas emissions to 25 per cent below 1990 levels by 2020 and 80 per cent by 2050. It was supported in the Senate by Liberal Senator Grant Mitchell and has been read twice but has since been adjourned in the name of Conservative Senator Richard Neufeld. The legislation cannot move forward until he speaks to it.... Mr. Neufeld said on Wednesday that there has been no organized effort to keep the bill from being passed into law. If it is not addressed before the Senate rises, probably next week, it can always be raised in the fall, he said. “Our chamber has been pretty busy,” said Mr. Neufeld.

But the Liberals say they fear that the Conservatives are stalling until they obtain an absolute majority of Senate seats and can unilaterally kill the legislation - something that is likely to occur in November.

And Mr. Hyer said he has been told by Conservatives that the government has decreed that the bill cannot be passed into law.

“There are a number of Conservative senators who I have met with, who I am not going to identify, who are very sympathetic,” he said, “but they say they are getting tremendous pressure - they are being whipped.”

The Climate Change Accountability Act was originally tabled in October 2006 in the Canadian House of Commons as Bill C-377 by Jack Layton, Leader of the New Democratic Party of Canada. It passed 3rd reading in that House with the support of caucuses of the Liberal Party of Canada, the Bloc Québécois and the NDP (the Conservative Party of Canada, led by Prime Minister Stephen Harper, voted against it). However, due to the 2008 Canadian federal election ending the parliamentary session prematurely, the bill did not achieve royal assent despite reaching the Senate. C-377 therefore died when the election was called.The parallels here between the 110th Congress and our situation are obvious enough that I don't need to draw them out, but here's the kicker: we don't actually vote for our senators.

The Senate consists of 105 members appointed by the Governor General on the advice of the prime minister.[1] Seats are assigned on a regional basis, with each of the four major regions receiving 24 seats, and the remainder of the available seats being assigned to smaller regions. The four major regions are: Ontario, Quebec, the Maritime provinces, and the Western provinces. The seats for Newfoundland and Labrador, the Northwest Territories, Yukon, and Nunavut are assigned apart from these regional divisions. Senators may serve until they reach the age of 75.I just want to make two little points towards the end of this quote-heavy post. One, when the Conservatives were out of power, all that I ever heard from my friends and their parents and, well, random dudes in restaurants wearing suits and cowboy hats, was that a Triple E Senate was a necessity to keep Canada from eventually breaking apart. The three Es stand for Elected, Equal, and Effective, as the Tories were weary of a senate stuffed full of liberals gumming up the works and, in their own little way, filibustering. Now that they're in power, and have been there long enough to have moved a number of people into the Senate, obviously they're not keen. Two, this bill is basically only demanding that Canada get to work on meeting the framework it has already agreed to in the United Nations. It isn't radical or overbearing or anything, it's had a series of readings, and it's already four years too late. Good god.

Thursday, July 1, 2010

Summer Reading

I have a few tabs open now. These tabs have been held open for too long now. My browser is getting sore. So, instead of deleting them, I thought I'd just post all the links here in a barrage of lazy, incoherence on my part. These links are not particularly thematically consistent (most of the news referenced therein is bad, so there's that). I just found them interesting, thought they were worth sharing, and figured at least a few of them might have slipped under a radar or two.

On Fossil Fuels:

- A Recent History of BP Being BP (Propublica)

- A Recent History of the Obama Administration Being Just Fine With BP Being BP (Rolling Store)

- Plus: Part Two

- Frakking Hell

Last month President Dmitri Medvedev of Russia said he would curtail natural gas production by the state company Gazprom until the study is completed. In part that’s because Medvedev isn’t sure there will be a viable market for Russian gas if the U.S. develops its domestic reserves, and because he believes that the regulations that could result from the EPA study could determine whether the U.S. drills its own gas, or imports it from overseas.So, on our fossil fuel problem: It's demand, stupid!

On economic development:

- Ersatz Development (an LSE lecture series podcast)

- Dani Rodrik saying a similar thing in three paragraphs

On Financial Crises and How to Fix Them:

- Marxism Illustrated (11 minutes long, totally worth it, and regardless of your views on the overall ideology, hard to argue with.

- "Not Good Enough," says Feingold (Ezra Klein)

There are times when even a highly imperfect reform is much better than nothing; this is very much the case for health care. But financial reform is different. An imperfect health care bill can be revised in the light of experience, and if Democrats pass the current plan there will be steady pressure to make it better. A weak financial reform, by contrast, wouldn’t be tested until the next big crisis. All it would do is create a false sense of security and a fig leaf for politicians opposed to any serious action — then fail in the clinch.As to how things stand now, I've yet to read a comprehensive run-down of the entire bill (or at least, what's likely to be in the final-est of final versions). So, though I'd like to agree with Russ Feingold as a matter of mancrush, and though I'd like to seek comfort in my original cynicism, I honestly can't judge here. I just don't know very much about the bill itself. I don't know how strong the strong derivatives language is. I don't know how protective the consumer protection will be. I don't know how tough the tougher proprietary trading rules are. Anyone?

So that's that. And, just saying and everything, I would totally welcome similar suggested reading posts from all of you.

Monday, June 28, 2010

This post is not about the G20

[T]hat is how the people at Pompeii, who's remains were found trapped and partly preserved within ghostly body-shaped tombs within that pyroclastic flow, died. They did not suffocate. They did not get blown apart by force. They did not die of gas poisoning. They simply cooked. Instantly.

Fuck. Yeah. That is some cool fuckin' research. For those who don't know (the details), Mt. Vesuvius, a still-active volcano 8 km away from Pompeii, erupted with extreme force in 79 AD, burying the city (and a bit of some other ones nearby) with ash and pumice. The type of eruption which occurred is still known as a "Plinian eruption," after the Roman author Pliny the Younger who described the eruption which killed his uncle Pliny the Elder in a letter to his friend Tacitus.

This research actually has important implications for disaster preparedness and discovery today, as such eruptions are rare and their effects have not been terribly well-documented. But forget that. Fucking awesome.

Original paper here.